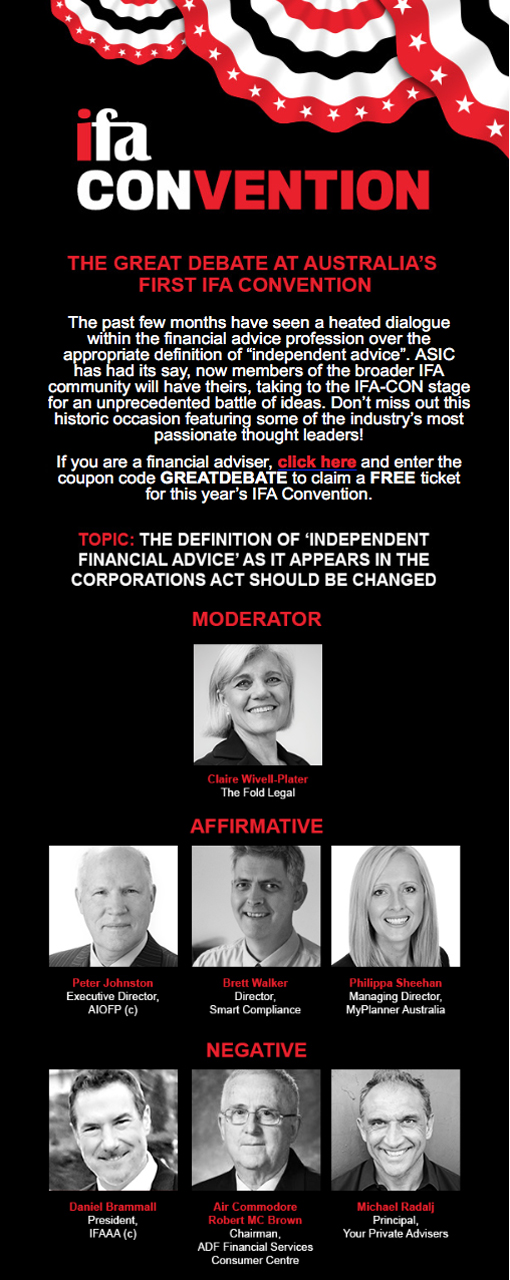

‘The Great Debate’ at the inaugural IFA-CON (Independent Financial Advisers Convention), Star City Casino, Sydney, September 7, 2017.

Topic: ‘The Definition of ‘Independent Financial Advice’ As It Appears in the Corporations Act Should Be Changed.’

Debate Team 1: Representatives of the Association of Independently Owned Financial Planners.

Debate Team 2: Representatives of the Independent Financial Advisers of Australia (IFAAA).

To give you an idea on what this great debate was about we refer to an article published by ASIC earlier this year, on the use of the term ‘independently owned’ along with other similar phrases in relation to the requirements for financial advisers under s923A of the Corporations Act. It was confirmed that words and phrases such as ‘independently owned’, ‘non-aligned’, ‘non-institutionally owned’ can only be used if the financial adviser meets the specific criteria set out in section s923A. Put simply, if an adviser receives any commissions or benefits that can mean a conflict of interest for the client, they are not able to define themselves as independent and therefore cannot use the terms ‘independently owned’ or any similar expression. ASIC Deputy Chairman Peter Kell has described how important the issue of independence is for consumers and investors. Consumers must not be misled by terms of ‘independence’ when an adviser who has a conflict of interest around the advice he/she provides is clearly not independent. To see more detail on the ASIC decision and questions around what it means to be s923A compliant, visit ASIC on s923A compliance.

As an independent adviser Michael Radalj was speaker No. 1 on the Negative. See what he had to say on the day about what it really means to be ‘independent’ in the post ‘Does money influence behaviour and possible advice?’